Global construction loses $2.5 trillion amid rising uncertainty and delivery risks

A new global report by Currie & Brown has revealed that uncertainty in project delivery has erased approximately $2.5 trillion in projected construction activity over the past year. Drawing from responses by over 1,000 decision-makers managing construction pipelines averaging $12.9 billion, the findings highlight a sector struggling to maintain confidence amid compounding challenges.

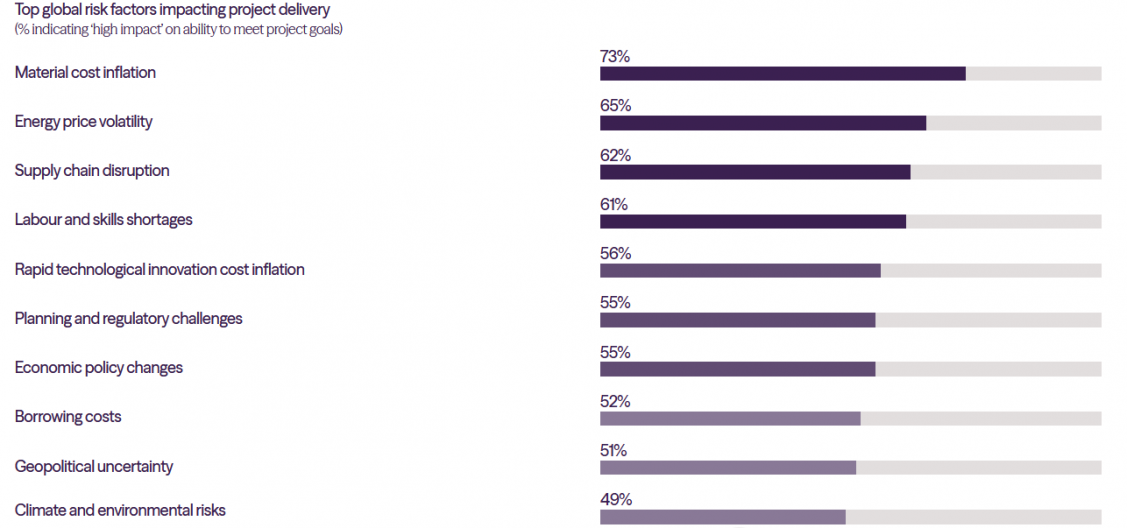

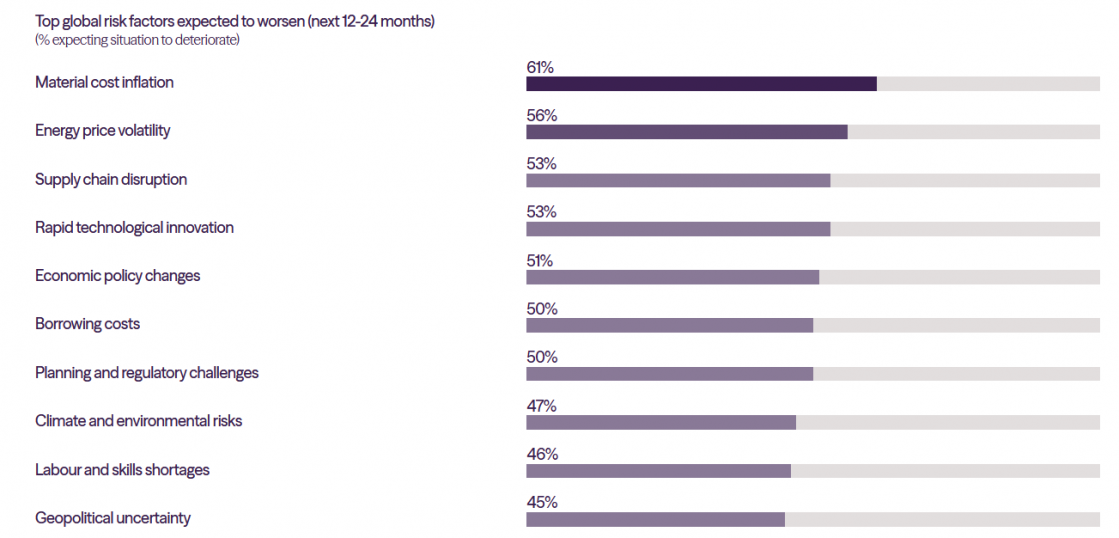

According to the Construction Certainty Index 2025, firms reported an average 13.7% financial loss on their annual construction pipeline due to factors such as cost inflation, supply chain instability, labour shortages, and energy price volatility. Nearly a quarter of all projects were cancelled, 32% were scaled down, and 29% experienced delays. Only one in five industry leaders expressed full confidence in delivering projects within budget under current conditions.

These findings correspond to systemic disruptions rather than temporary fluctuations. The report stresses that global construction, a key driver of infrastructure, housing, and economic development, now faces a structural challenge in maintaining delivery certainty.

Currie & Brown’s report outlines both external and internal contributors to the instability. Externally, construction firms continue to absorb the aftershocks of geopolitical conflicts, climate-related disruptions, and volatile commodity pricing. Internally, inefficiencies such as outdated procurement practices, incomplete designs at contract stage, and fragmented project governance exacerbate delivery risks.

The report’s foreword by Group CEO Alan Manuel underscores that today’s pressures “overlap and spread across industries and borders.” He notes that the intersection of inflation, energy volatility, and regulatory shifts magnifies project risks globally. These forces collectively drive costs, reduce trust, and heighten delivery uncertainty.

In addition, the report reveals a persistent “technology paradox.” While many firms have adopted digital tools, such as Building Information Modelling (BIM) and predictive analytics, their implementation often lacks integration into broader project strategies. As a result, technology investment remains underutilized, and data-driven decision-making is inconsistent across regions.

Currie & Brown proposes a roadmap for restoring resilience through five key strategies: aligning technology with strategic objectives, improving data confidence, rebalancing contractual risk, developing workforce capacity, and fostering collaboration. The firm is also introducing the Construction Certainty Index, a benchmark designed to track market confidence and risk trends across sectors.

The broader implications of uncertainty extend beyond individual projects. Delayed or cancelled developments translate into fewer hospitals, schools, and housing projects worldwide. As governments and private investors aim to drive energy transition and infrastructure renewal, the findings serve as a clear signal that strengthening certainty must be prioritized across the entire project lifecycle.

Sources: curriebrown.foleon.com, prnewswire.com, ccemagazine.com, constructionmachinerymenews.com

Want to read more like this story?

Data-Driven Construction: The Key to Meeting Global Infrastructure Demands

Feb, 14, 2025 | NewsAs the global population is set to reach 9.7 billion by 2050, the demand for new and upgraded infra...

The Price of Progress: Why UK Infrastructure Costs Need Reform

Oct, 10, 2024 | NewsThe rising costs of infrastructure projects in the UK have been a significant concern for decades,...

London: The World’s Most Expensive City for Construction in 2024

Apr, 16, 2024 | NewsLondon has emerged as the most expensive city for construction in 2024, narrowly edging out Genev...

2024’s Construction Boom: What It Means for 2025 and Beyond

Nov, 29, 2024 | NewsThe construction industry in 2024 demonstrated resilience and growth, marked by a 10% increase in n...

The correlation between direct work and productivity in construction industry

Jul, 16, 2020 | NewsA new study focuses on a crucial relationship that impacts the construction industry. The correlatio...

Civil Engineering in the Digital Age: Top Innovations Shaping the Future

Jul, 16, 2024 | NewsThe world of civil engineering is experiencing a significant digital transformation. Innovative tec...

Forecast that construction market will reach $13 trillion by 2022

Nov, 01, 2018 | NewsA research by GlobalData suggests that the international construction market output will hit ab...

$280bn in construction projects to be invested in Qatar for FIFA World Cup

Jan, 28, 2015 | NewsThe 2022 FIFA World Cup to be held in Qatar, has brought a boom in the construction sector with ...

Record Growth in UK Construction: Civil Engineering Leads the Way

Aug, 07, 2024 | NewsSurge in Construction Activity The UK construction sector has experienced its fastest growth in ov...

Trending

Vertical gardens in Mexico City to combat pollution

Saudi Park Closed After 360 Big Pendulum Ride Crashes to Ground, 23 injured

Characteristics of Load Bearing Masonry Construction

Taipei 101’s impressive tuned mass damper

Dutch greenhouses have revolutionized modern farming

Federal court rules Biden’s offshore drilling ban unlawful