A quantitative analysis on natural disasters and their economic impact

Much has been said about the environmental dimension of natural disasters, as well as their connection to climate change. But what are their purely financial effects and what is the burden they cause on insurance companies? A relevant study by the Swiss reinsurance company (that is, a company that provides insurance to insurance companies) Swiss Re attempts to answer these questions.

According to this study, in 2023 natural disasters caused USD 280 billion in losses worldwide, of which USD 108 billion was covered by insurance companies.

For insurance companies, more worrying than the absolute numbers is the continued upward trend in the annual amounts they are forced to pay out as compensation due to natural disasters. Specifically, separating the annual variability from the long-term trend, the upward trend is exponential (i.e., steeper than linear), with the average annual increase in insured losses in the decade 1994-2003 being USD 1.9 billion, in the decade 2004-2013 rising to USD 2.8 billion and in the decade 2014-2023 to USD 5.3 billion by year.

It is estimated that over the past 30 years, insured losses from natural catastrophes have grown faster than the global economy, by 3 percentage points more per year (in inflation-adjusted terms). The forecast is that insured losses will increase by 5-7% per year in the long term, with a potential doubling of today's level in just 10 years.

In many countries the natural disasters that occurred in 2023 were the costliest events of all time. For example, the hurricane Otis in Mexico, the floods in Greece and Slovenia, the earthquakes in Turkey and Morocco, the cyclone Gabrielle in New Zealand were the costliest natural disasters of all time in these countries.

2023 record event

The earthquake in Turkey was the costliest catastrophe in 2023, both in absolute numbers of economic losses (USD 58 billion) and specifically for the global insurance industry. Despite the earthquake hitting an area of low insurance penetration, with 90% of assets uninsured, estimated insured losses from the Turkey earthquake reached USD 6.2 billion. This low insurance penetration, in addition to demonstrating the large safety gaps that exist in various regions of the world, also shows where total insured losses could reach in 2023 if most of the earthquake losses were insured.

Which type of disaster is becoming increasingly costly?

The natural catastrophe category that caused the most insured losses in 2023 was severe convective storms (SCS) at USD 64 billion, nearly double the previous 5- and 10-year averages. In recent years, SCSs have been established as the second most damaging hazard after tropical cyclones (TCs). The costliest feature of these storms is hail, with the increasing number of glass solar installations playing a major role in this type of losses.

The role of climate change

The role of climate change in increasing natural disasters is still relatively controversial. In the case of SCSs in particular, of the 8% average annual losses increase, it is estimated that about 1% (ie, one-eighth of the increase) is due to climate change. A larger portion of the increase is attributed to urbanization and spatial expansion, which alone are estimated to drive relative losses 2.3% higher annually.

Event frequency

In many of the previous years, there was a very catastrophic event that accounted for a significant portion of the total cost. These events are usually (but not only) hurricanes. For example, such events occurred in 2005 (Hurricane Katrina – USD 102 billion), 2011 (Tohoku Earthquake, Japan - $47 billion), 2017 (Hurricanes Harvey, Irma and Maria (HIM) - $43 billion), and 2022 (Hurricane Ian - $62 billion). In 2023, although there was no such peak event (the costliest event cost $6.2 billion, as mentioned above), total insured losses again exceeded $100 billion, one of the highest amounts ever.

This is due to the huge increase in the total number of events. Indicatively, for the year 2023, 142 separate events were recorded, the most by a margin of any other year (the average number of events of the last decade was about 100 per year, while for the decade 1994-2003 it was about 60 per year). Thus, for 2023 losses, the frequency of events was the main driver.

Regarding the categorization of events by severity, the number of "moderate severity" events (costing USD 1 billion to USD 5 billion each) has increased by 7.5% annually over the last three decades, much higher than the number of "high severity" events (more than USD 5 billion each) with 2.8%, as well as the number of "low severity" events (less than USD 1 billion each) with 3.5%.

Aftermath

The data shows that not only are high insured losses here to stay, but the general trend is for them to continue to increase rapidly. Even in the absence of major catastrophes, insured losses are not guaranteed to remain low due to the ever-increasing number of events.

Moderate severity events are increasing faster than other categories, as are losses from severe convective storms. The role of climate change is perhaps still small but probably growing.

Additional adaptation measures are becoming necessary, such as enforcing building codes, building flood protection infrastructure, and discouraging settlements in areas prone to natural hazards, as well as mitigating greenhouse gas emissions. It remains to be seen how things will develop in 2024 and in the following years as well.

Source: Swiss Re Institute

Want to read more like this story?

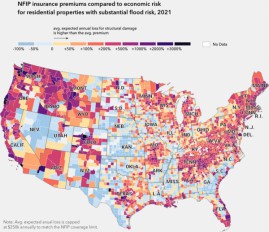

Flood risk increase for US infrastructure due to climate change: Insurance rates tend to underestimate the current conditions

Mar, 01, 2021 | NewsThe risk of flooding can cause severe damage to infrastructure. New evidence revealed that the poten...

September 7, 1999: a strong earthquake struck Athens, Greece

Sep, 08, 2023 | NewsOn September 7, 1999, Athens experienced a catastrophic earthquake. The event resulted in the loss...

Remote sensing of natural hazards (ORISAT)

Jul, 12, 2023 | EventVolcanoes, glaciers, landslides, faults: these are all natural objects that can pose a major risk to...

UN’s report: Record amount of renewable energy capacity added in 2016

Nov, 08, 2017 | NewsLargely due to rapidly falling costs of clean energy, global renewable energy capacity jumped 8% las...

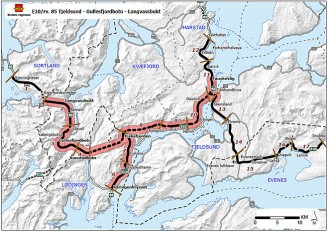

Norwegian Public Roads Administration awards €1 billion highway contract

Apr, 27, 2023 | NewsThe Norwegian Public Roads Administration (NPRA) has awarded the contract for the construction of t...

Experts answer: “Why did so many buildings collapse in Turkey?”

Feb, 16, 2023 | NewsFollowing Monday's terrible earthquakes, many of people are reportedly still trapped in the rubble...

5.8-magnitude earthquake strikes Ecuador coast: damaged buildings, huge loss of property, no tsunami

Mar, 28, 2022 | NewsA huge loss of property was suffered when an earthquake of magnitude 5.8 struck Ecuador coast on Sa...

Earthquakes: five deadliest earthquakes ever recorded around the world

Feb, 25, 2022 | NewsEarthquakes are one of the most dangerous natural disasters. More than 100 earthquakes of the magni...

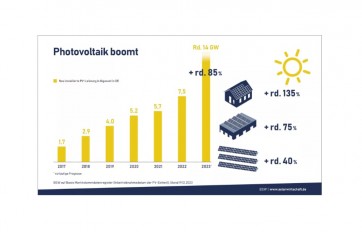

Germany installs 14 GW of renewable solar energy in 2023

Jan, 05, 2024 | NewsGermany’s Federal Network Agency (BNetzA) announced, based on preliminary figures, on January 5 tha...

Trending

Taipei 101’s impressive tuned mass damper

Characteristics of Load Bearing Masonry Construction

China Completes World’s Longest Expressway Tunnel, Redefining Connectivity

The Line at Neom faces feasibility reassessment while construction continues

The Billion-Dollar Airport Boom: 2025 Megaprojects Shaping the Skies

World's longest expressway tunnel to link northern and southern Xinjiang